December 21st 2009

Fears of Sovereign Debt Default Enter the Forex Fray

As if forex traders didn’t have enough to worry about these days, now there is a new concern- that of sovereign debt default. The last couple months have witnessed a spate of minor episodes, all of which paint a picture of frightening cohesiveness about the state of sovereign finances, and the ability of countries to continue to finance and service their debt. As the economic recession moves into recovery (or at least, permanently distances itself from the prospect of depression), the markets will likely turn their gaze towards the long-term, with this issue looming large.

It’s difficult to know where to begin, since people have been talking about the perennial budget deficits of the US for many years. As a result of the economic downturn (stimulus programs and falling tax revenues), these budget deficits have taken on truly awesome proportions. The 2009 deficit came in at a record $1.4 Trillion, and the deficit in the fiscal year-to-date 2010 is close to $300 Billion.

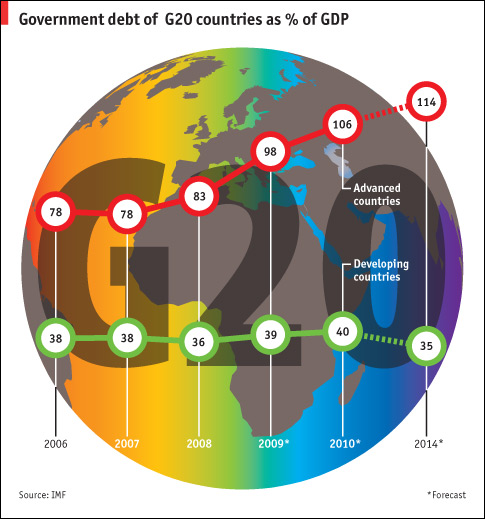

The US, of course is far from alone, with virtually every nation (industrialized and developing, alike) operating in the red. Canada, Britain, Japan…even China – known for its fiscal prudence – are setting records with their budget shortfalls.

As a result, “Moody’s…suggested that the countries’ triple-A ratings could face downgrades in coming years.” Greece’s sovereign debt was already downgraded, from AAA- to BBB+, while Spain has received a warning. Dubai is in technical default, but this is old news.

It’s not as if any of this is surprising, or even new. Greece, for example, was running 10% budget deficits during the height of the credit bubble. With the bursting of the bubble, however, sovereign fiscal problems have both been both exposed and exacerbated. If ever there was a time when national governments could be expected to get their fiscal houses in order, this is not it.

At this point, the markets appear to have resigned themselves to sky-high deficits for the immediate future, and have now begun to assess the implications rather than try to encourage governments to straighten out. Even though the US budget deficits and national debt are the highest in nominal terms, its Treasury bonds still remain the standard-bearer for global capital markets. Proving that point is that new Treasury issues are repeatedly oversubscribed, despite rock-bottom rates. “For every $1 of debt sold by the Treasury this year, investors put in bids for $2.59, up from $2.19 at this point in 2008.” Most importantly, the largest creditor – China – is headlining demand. Granted, the costs of insuring US debt (via credit default swaps) is rising, but investors generally remain cautiously optimistic about US finances.

The story on the other side of the Atlantic is not nearly as upbeat. Investors responded to the downgrade of Greece’s credit rating, by pushing up the yield on its debt by 50 basis points, raising the spread to 2.5% over comparable German sovereign bonds. Ireland, meanwhile, is projecting a budget deficit of 13.2% this year, and Austria is receiving scrutiny for its banks’ risky lending practices in Eastern Europe. “The question for Europe now is how much more solvent are countries like Italy, Portugal and Spain…Could it be that these are the regions where the next financial shoe is going to drop?” Asked one analyst.

The more important question is what would happen in the event of default, or even a spike in bond yields by a member of the EU. Technically, the treaty behind the European Monetary Union “contains a ‘no bail-out’ clause that prohibits one country from assuming the debts of another.” It seems hard to believe – from where I’m sitting at least – that other countries would sit by idly if one member began moving inexorably towards bankruptcy. Investors are certainly not blind to the notion of an implicit guarantee, which helps the weak at the expense of the whole. That could explain why Greek and Spanish bonds remain comparatively buoyant, while the Euro has suffered in recent sessions.

Then, there is the UK. Of all of the world’s major economies, the UK is arguably in the most precarious financial position, especially relative to its size. As one commentator lamented, “Indeed, the cost of our [UK] government borrowing – as measured by the interest rate – is rising so quickly that within a month it could be higher than Italy’s.” He goes on to discuss how inflating away the debt would be pointless, given the sophistication of investors and the fact that government liabilities are indexed to inflation, and hence would offset any gains from debt devaluation. He concludes: “The solution to today’s fiscal crisis is the same as it has always been: to cut spending, reduce the deficit and learn to live within our means.” Based on modern history, that seems pretty unlikely. Could Britain, then, become the first industrialized country to default on its debt? Forex markets: take note.

Then, there is the UK. Of all of the world’s major economies, the UK is arguably in the most precarious financial position, especially relative to its size. As one commentator lamented, “Indeed, the cost of our [UK] government borrowing – as measured by the interest rate – is rising so quickly that within a month it could be higher than Italy’s.” He goes on to discuss how inflating away the debt would be pointless, given the sophistication of investors and the fact that government liabilities are indexed to inflation, and hence would offset any gains from debt devaluation. He concludes: “The solution to today’s fiscal crisis is the same as it has always been: to cut spending, reduce the deficit and learn to live within our means.” Based on modern history, that seems pretty unlikely. Could Britain, then, become the first industrialized country to default on its debt? Forex markets: take note.

December 25th, 2009 at 1:47 pm

[…] Adam Kritzer dives into the subject of sovereign foreign debt, and how it affects forex. […]