September 9th 2009

China’s Economic Recovery and the RMB

By now, the notion that the nascent global economic recovery is being and will continue to be led by China has become cliche. The NY Times summarized: “In past global slowdowns, the United States invariably led the way out, followed by Europe and the rest of the world. But for the first time, the catalyst is coming from China and the rest of Asia, where resurgent economies are helping the still-shaky West recover from the deepest recession since World War II.”

The statistics are certainly compelling. After a brief dip in the first quarter, GDP grew by an impressive 7.9% in the second quarter. In hindsight, the downturn in Chinese economic output was so slight as to hardly warrant use of the term recession to describe it; any other country would have rejoiced after achieving 6.1% (2009 Q1) growth, especially in the context of the current economic climate.

While stock market investors are evidently optimistic that the economy will continue to gather momentum, China-watchers and policymakers are more cautious. Wen Jiabao, premier of China, insisted that, “We must clearly see that the foundations of the recovery are not stable, not solidified and not balanced. We cannot be blindly optimistic.”

Wen’s downbeat prognosis should be seen in the context of China’s massive stimulus plan, which delivered an immediate jolt to the economy, but is already winding down. “The flood of bank lending in the first half of this year — equivalent to more than half of gross domestic product in the period…is ebbing. Net new lending in July was 355.9 billion yuan ($52.13 billion), the lowest figure so far this year and well below the first half’s monthly average of 1.2 trillion yuan.” Some analysts believe that this sudden decrease is due to seasonal factors, but others argue that it is a sign that the boost in lending (and spending) from the stimulus may have already exhausted itself.

In addition, the stimulus itself was not necessarily geared towards sustainable growth (in the economic, not the environmental sense). Over the last two decades, China embraced an economic model focused around exports and capital investments, at the expense of domestic consumption. While it will certainly be years before economists can determine whether the recession changed the structure of China’s economy, the earliest indications point to business as usual. “This year the bulk of the government’s stimulus is going into infrastructure, further swelling investment’s share. Chinese capital spending could exceed that in America for the first time, while its consumer spending will be only one-sixth as large.”

To be sure, the government has rolled out incentives and subsidies designed to reduce savings and increase consumption. However, Chinese cultural mores and the government’s lack of social services represent a formidable obstacle to any opening-up of the mentality of Chinese consumers- and their wallets. In fact, while China’s government is still nominally Communist, spending on public services is among the lowest in the developed world. Despite doubling to 6% of GDP, such spending is still well below the OECD average of 25%. The widening rich-poor gap, meanwhile, suggests that most of the windfall from China’s economic boon has been bestowed upon a relative handful of businesses and people, such that the majority of China’s 1.3 Billion populace simply doesn’t have the means to increase consumption.

For better or worse, the global economic downturn has severely crimped demand for Chinese exports, and this component of GDP could remain depressed for quite some time. After a record $400 Billion in 2008, the trade surplus plummeted in 2009, “to $35 billion in the same [second] quarter, 40% down on a year earlier…the decline is even more impressive in real terms (adjusting for changes in export and import prices), with the surplus shrinking to less than one-third of its level a year ago.” In fact, some analysts project that China could soon experience a trade deficit, if current trends continue.

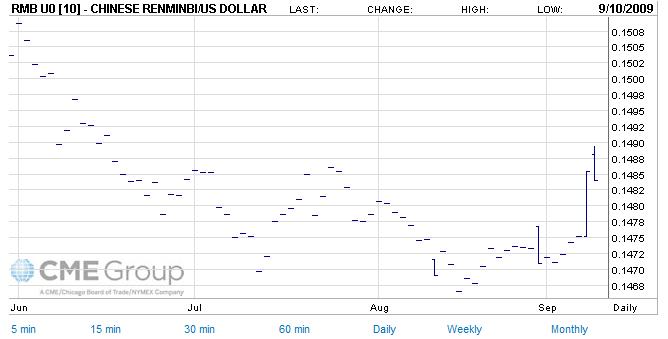

All of this suggests that the Chinese RMB is not likely to return to its path of rapid appreciation (28% in real terms), observed from 2005-2008. (The currency has essentially been fixed at 6.83 RMB/USD since December 2008, leading to an 8% decline in real terms to match the decline of the Dollar.) China’s foreign exchange reserves, which have come to mirror the appreciation of its currency, are once again expanding. ($2.13 Trillion at last count). Given the decline in the trade balance and the explosion in the budget deficit, however, much of this increase must be attributed to the inflow of speculative capital, which will not necessarily translate into currency appreciation.

Some economists insist that the Yuan is still undervalued by as much as 25%, but investors don’t believe that it will bridge this gap anytime soon. While the spot exchange rate has risen to the strongest level since May, futures prices indicate a modest 1.5% appreciation against the Dollar over the next twelve months. This is an improvement from expectations of a flat exchange rate, but still a long way away from what some economists think is reasonable.

September 13th, 2009 at 3:35 pm

Good article. Would be interesting to see if demand will continue to fall in the coming months, since China relies so much on exports.