July 2nd 2009

Interview with Zachary Storella: “Be quick and agile.”

Today, we bring you an interview with Zachary Storella of Counting Pips. He is a self-professed “independent forex trader and blogger.”

Forex Blog: CountingPips purports to offer investors “Forex Trading and Currency Information,” so I would would like to begin by asking you to outline what you perceive to be the most important themes at this stage of the economic downturn, especially as they bear on forex markets?

The major theme at play at present in the currency markets is the risk aversion versus risk appetite scenario. The risk appetite currencies have been doing quite well since early March compared to the safe havens although I think that the rally in the risk currencies may have come too far, too fast and we could be ripe for a possible correction on that front.

Well, I would tend to agree with the view out there that the global economy has probably bottomed on the evidence that the pace of decline has cooled off in many of the important economic indicators. That being said, the global economy as a whole and the economy here in the U.S., is still very weak and has a ways to go to get back on track. I am absolutely keeping an open mind in terms of the direction the global economy might take because we just witnessed a (hopefully) once-in-a-lifetime event in the financial crisis and there are many global inequalities and inefficiencies that need to be worked out and that will take time. So going forward, it looks promising but we are still in the midst of a deep recession and there are bound to be surprises.

Well, it is being said that the global recovery may be a China led recovery. I think it’s too early to tell if that will be the case. I think that there is a good chance that decoupling can be more realistic in the future as emerging economies develop. Of course, many thought that before only to be proven dramatically wrong in the last year. So really it is hard to tell until it happens…It seems to make sense in theory but the reality is a different story.

Yes, I think right now the fundamentals have taken a backseat to the general risk theme but the further away from the financial crisis we get I think we will see the fundamentals become stronger catalysts. I think it makes sense, right now on the heels of the financial crisis, an unprecedented event in recent times, that we need to work through this period before the normal rules apply again.

I think it is an accurate reflection of market developments. The high-yielders have been doing very well as of late, with some of the more exotic carry trade currencies like the Brazilian Real and South African Rand making some real moves.

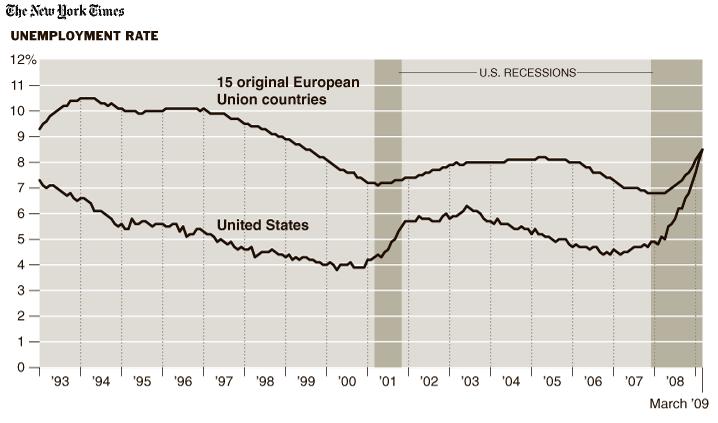

At the present time, the comparison in the numbers, I don’t see it as having a huge relevance as it pertains directly to forex trading. The Nonfarm Payrolls data release is obviously big and definitely moves the markets. I see that data as helping to drive the risk mood one way or the other and traders can use it in that context. So the number comparison doesn’t mean much to me but of course, another more insightful trader could see something in it and I could be wrong.

Forex Blog: Judging from its meeting this week, do you anticipate the Fed will raise rates in the near-term? How do you think such rate hikes (or lack thereof) will weigh on forex markets?

I don’t feel that we will see the Fed raise rates in the near term as inflation is not a problem as of yet and our economy is just too fragile at the moment. It doesn’t seem warranted. I think when rates do move higher it will bear weight on the forex market as the US economy will be in a different place, probably starting to see more inflationary pressures and/or the economy will be growing. On an overall basis, I am very interested to watch and see which economies pull out of the recession first, start raising rates and how the global economy develops from here, who leads where and what the implications are then for the currency markets.

Be quick and agile.