July 13th 2009

Chinese Yuan Poised for Appreciation

I toyed with today’s headline for a while, given that an equally cogent case could be made for either “Chinese Yuan Poised for Significant Appreciation” or “Chinese Yuan Poised for Stability.” Let’s face it- when it comes to to the Chinese Yuan, it’s a complete guessing game, since you’re not only dealing with the normal factors that affect currencies, but also with the whims of China’s Central Bank. Still, I think that the Yuan will continue to appreciate slowly and steadily, because such is in the best interest of China.

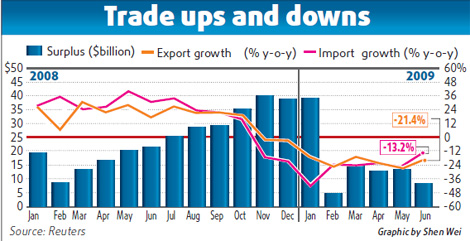

For the sake of context, consider that the Central Bank has held the Yuan around $6.83 for the better part of a year now, since the advent of the credit crisis. Prior to that, it had appreciated nearly 20% over the previous three years. The reason China has been able to get away with holding the Yuan constant for such a long period of time is the collapse in its trade surplus. Meanwhile, inflation has abated, down from a high of 7% to the current level of near 0%. As a result, the Central Bank can now have its cake and eat it to, by holding the Yuan constant without worrying about the effect on prices.

The most recent forecasts, however, suggest this is about to change. According to the World Bank, “China’s current-account surplus is likely to reach $388 billion in 2009…while foreign-exchange reserves will likely rise by $218 billion to $2.168 trillion at the end of this year.” Depending on who you ask, China’s economy is on track to grow by 7.2% to 7.5% in 2009, and by 8.5% in 2010. These forecasts represent upward revisions, and “Private economists have also been upgrading their outlook for China’s economic growth this year in the past couple of months since some major indicators including fixed-asset investment and industrial output growth have shown signs of improvement.” Second-Quarter GDP is scheduled for release in the next week, at which point we will likely see another round of revisions.

If such growth materializes, this would place China in a dilemma, such that it would have to choose between higher prices or more expensive currency. According to the Royal Bank of Scotland, “Policy makers will keep benchmark interest rates on hold this year because of declining consumer prices,” which implies, “The yuan will strengthen to 6.7 by the end of 2009 and 6.5 a year later.” Chinese Premier Wen JiaoBao agrees that “China should stick to an appropriately loose monetary stance and an active fiscal policy.” This notion is also reflected in futures prices, which have priced in a modest 1-2% rise in the Yuan over the next year [compared to previous expectations of a 5% decrease].

Economics aside, there is another major reason why the Yuan should continue to appreciate. China has been clamoring for several months now for a decline in the Dollar’s role as the world’s reserve currency, and a commensurate rise in the Yuan. Already, the country has started to take steps to increase the use of Yuan in settling cross-border trade, and “HSBC predicts that by 2012 nearly $2 trillion of annual trade (over 40% of China’s total) could be settled in yuan, making it one of the top three currencies in global trade.”

Still, the currency is still nowhere near satisfying the requisite convertibility inherent in reserve currencies. According to one analyst, “China would need to scrap capital controls so foreigners could invest in yuan assets and then freely repatriate their capital and income, but the government is wary of moving too quickly. A reserve currency also requires a deep and liquid bond market, free from government interference.” If China is able to achieve any of these feats, capital will likely pour in at an even faster rate, making an appreciation in the Yuan once again self-fulfilling.