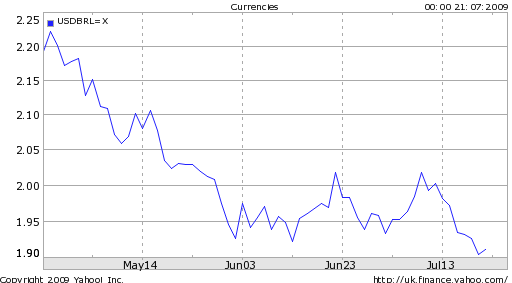

July 22nd 2009

Brazilian Real Surges Ahead

In the last three months alone, the Brazilian Real has risen by an impressive 15% against the Dollar alone. What’s driving this impressive importance? The lead paragraph for one article offered the following encapsulation: “Brazil’s real climbed to the highest in more than nine months as stronger-than-estimated corporate earnings, rising equities and higher metal prices bolstered the outlook for Latin America’s largest economy.”

These factors certainly represent a good starting point for any analysis of the Real. As signs continue to emerge that the global economy – and China specifically – have turned a corner in their fight to overcome recession, commodities will likely continue to rally, which is excellent news for Brazil bulls. In addition, “May industrial production and especially retail sales came in stronger than expected, following incipient signs of improvement in labor and credit conditions, consumer and investor confidence, and inventory levels.” As a result, after a modest contraction in 2009 (the bulk of which took place in the first quarter), 2010 is expected to mark a return to solid growth, with estimates ranging from 3.5% to 4.5%, rising to 5% in 2011.

The Central Bank of Brazil, however, is not necessarily on the same page. Last week, it cut rates to a record low of 8.75%, in order to ensure that Brazilian monetary policy remains easy enough to support growth. While this is an unwelcome development for carry traders, there are a few mitigating circumstances. First, considering that Brazilian inflation is projected to average 4.5% in 2009, this still affords investors a solid 4% real return, without factoring in currency fluctuations. Second, Brazilian rates are still significantly higher than levels in industrialized countries, such that the interest rate differential which makes Brazil attractive has been carefully preserved. Finally, while precise forecasts vary, the Central Bank is expected to begin hiking rates as soon as the end of this year, with further hikes throughout 2010.

The Central Bank has also been busy on other fronts. Thanks to a healthy trade surplus, its foreign exchange reserves are burgeoning, recently touching a record $209 Billion. This figure well exceeds Brazil’s outstanding debt, which gives it great flexibility in determining how to allocate these reserves. Already, the Central Bank has begun to pare down its holdings of US Treasury securities, in search of higher-yielding alternatives. In addition, the Central Bank has taken to intervening regularly in the forex spot market, in a vain effort to stem the rise of the Real.

In the short term, analysts are now lining up around various technical levels, backed by little real fundamental analysis. “Moreover, without fundamental economic news showing better times ahead for the U.S. economy, principally, then the BRL1.90 support will remain cemented in place,” offered one analyst. “You show me some more good news and the support will be closer to 1.85,” argued another. It looks like traders are just looking for excuses to keep bidding up the Real.