May 13th 2009

Central Bank Mulls Intervention to Hold Down Singapore Dollar

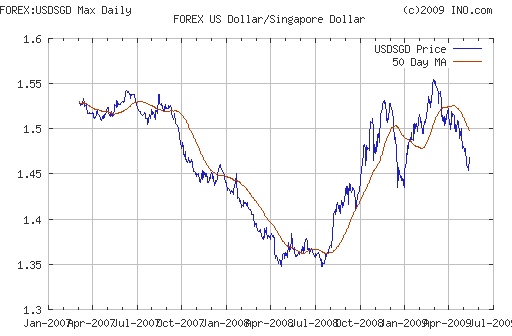

While the Singapore Dollar hasn’t been punished to the same extent as its counterparts, the currency was nonetheless dealt a strong blow by the credit crisis, falling 20% in a matter of months, after peaking in 2008. For its part, the Monetary Authority of Singapore (MAS)- which functions as the Central Bank- couldn’t have been happier. The currency had fallen just enough to almost completely offset its rise during the leadup to the crisis.

Now, with a global stock market rally underway and a modest economic recovery taking shape on the horizon, the Singapore Dollar has quickly erased almost half of its slide. The Central Bank naturally, is alarmed, and is threatening to intervene. While the MAS, itself, has thus far denied such a possibility, insiders suggested that “The Monetary Authority of Singapore will buy the U.S. dollar “‘f it falls below S$1.4700, around S$1.4690…’ [which] roughly equates with the strong end of the undisclosed trade-weighted band that the MAS uses to guide the Singapore currency.” Curiously enough, the Singapore Dollar beat a retreat this week, after rising all the way to $1.45.

Now, with a global stock market rally underway and a modest economic recovery taking shape on the horizon, the Singapore Dollar has quickly erased almost half of its slide. The Central Bank naturally, is alarmed, and is threatening to intervene. While the MAS, itself, has thus far denied such a possibility, insiders suggested that “The Monetary Authority of Singapore will buy the U.S. dollar “‘f it falls below S$1.4700, around S$1.4690…’ [which] roughly equates with the strong end of the undisclosed trade-weighted band that the MAS uses to guide the Singapore currency.” Curiously enough, the Singapore Dollar beat a retreat this week, after rising all the way to $1.45.

The Singapore Dollar is generally considered a bellweather for the currencies of neighboring countries. Singapore is seen as having a model economic policy, and the Singapore Dollar is somewhat immune from the shocks that affect other currencies because its fluctuation is controlled via a loose band by the city-state’s Monetary Authority. The exchange rate is basically used in lieu of conventional monetary policy ( i.e. adjusting interest rates), although market supply/demand plays a significant role. You can think of the MAS as performing a sort of smoothing function.

In this way, the MAS is acting similarly to the Swiss National Bank, which professes to manipulate its exchange rate in order to prevent deflation- not to increase the competitiveness of exporters. According to a top MAS official, “We keep our monetary policy [based] on the medium-term inflation outlook and taking into account growth prospects. We don’t use the currency for competitiveness because it is not sustainable to align currencies just for competitiveness.” This is somewhat plausible as the MAS intervened similarly during the last downturn, in order to forestall a systemic drop in prices.

As always, the line between maintaining price stability and increasing demand is thin, since the latter is in fact used to bring about the former. This is especially true with Singapore, whose economy is largely dependent on exports to drive growth, and hence has been hit especially hard by the downturn. “In the first quarter of 2009, calculated on an annualized basis, Singapore’s economy contracted at a record rate of 11.5 percent from a year earlier, and 19.7 percent from the previous quarter.” [See Chart] As a powerful symbol of just how bad things are, the New York Times recently reported that over 700 cargo ships are docked near and around Singapore, idling as a result of slackened trade. Maybe the MAS noticed…

May 22nd, 2009 at 8:12 am

[…] actively intervened to hold their currencies down, while Malaysia and Singapore (discussed in a Forexblog post last week) have also intervened for the sake of […]