May 17th 2009

Carry Trade Lifts Hungarian Forint

The rally in emerging markets and accompanying revival of the carry trade can be seen clearly in the Hungarian Forint, which can now claim the distinction of being the world’s best performing currency. You’re probably scratching your head and/or rolling your eyes, but bear with me.

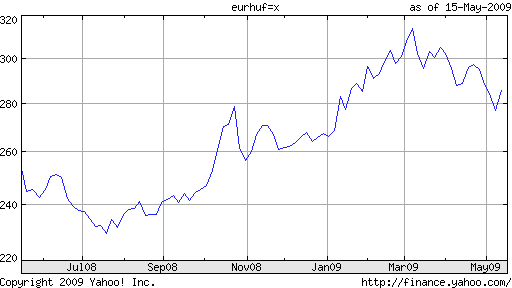

Beginning last July, shortly before the peak of the credit crisis, the Forint began to fall rapidly. It quickly lost more than half of its value against the Dollar, but then again so did a bunch of other currencies. The more relevant comparison is with the Euro, against which the Hungarian currency also fared quite poorly. Despite a 13% rally over the last two months, the Forint is still down 27% from its high last summer.

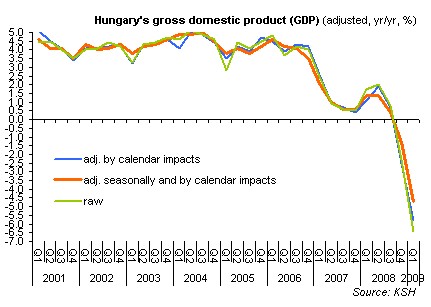

This is understandable, since Hungarian economic fundamenals are commensurately poor. “Household consumption is shrinking due to a drop in wages and narrower borrowing opportunities, while investments are hit by a lack of funds and a global economic downturn.” Factor in an 18.7% annualized decline in exports, and the result is a 6.4% decline in GDP for the most recent quarter.

Hungary’s economic woes have not gone unnoticed. “The International Monetary Fund, the EU and the World Bank have pledged 20 billion euros ($27 billion) of emergency loans to support Hungary, the biggest aid package for a European nation alongside Romania.” While financial markets have stabilized, credit default swap rates indicate investors are still concerned about the possibility of default. Meanwhile, Hungary has now been officially rejected (for the second time) by the European Monetary Union, such that its doubtful that Forint will ever be absorbed into the Euro.

Why, then, is the Forint rallying? The answer is simple: high interest rates. The benchmark Hungarian interest rate is a lofty 9.5%. While other Central Banks have been busy lowering rates to try to boost economic growth, “The Monetary Council of the central bank voted unanimously on April 20 to keep rates on hold at 9.50 percent.” Given the precarious financial situation, its economic policymakers are concerned that a drop in interest rates could precipitate capital flight and a currency crisis.

An exasperated Deputy Central Bank Governor explained to reporters, “As long as Hungary is considered such a vulnerable country, our interest rates cannot be lower than South Africa’s or Turkey’s; it’s not the Czech Republic, Slovakia or Poland you should compare us to.” She has clearly been paying monitoring the forex markets and knows that now is not the time to gamble with investors’ sudden return to Hungary.

Analysts remain divided over whether the upward trend in the Forint is sustainable. For its part, “Deutsche Bank recommends investors sell the euro against the forint on bets the rate difference will help the Hungarian currency gain 10 percent to 260 per euro in two to three months from 286.55 today.” However, it will be difficult for the economy to stage a serious economy for as long as the currency is rallying, which is why a survey of analysts revealed a median forecast of a medium-term decline in the Forint.